Personalized Service

Personalized service to customers, which is based on three fundamental pillars:

- Give direct access to the main stock markets in the world and thus better investment alternatives.

- Portfolio of greater modernity, with a Dynamic Investmet Service (DIS), according to the risk profile of each client, based on a Long-Term Structural Portfolio (LTSP) and a Short-Term Dynamic Portfolio (STDP), specially designed for markets with high volatility in constant variation

- Analysis of the markets from a Fundamental perspective (40%), and from the point of view of Technical Analysis (60%).

Differentiation

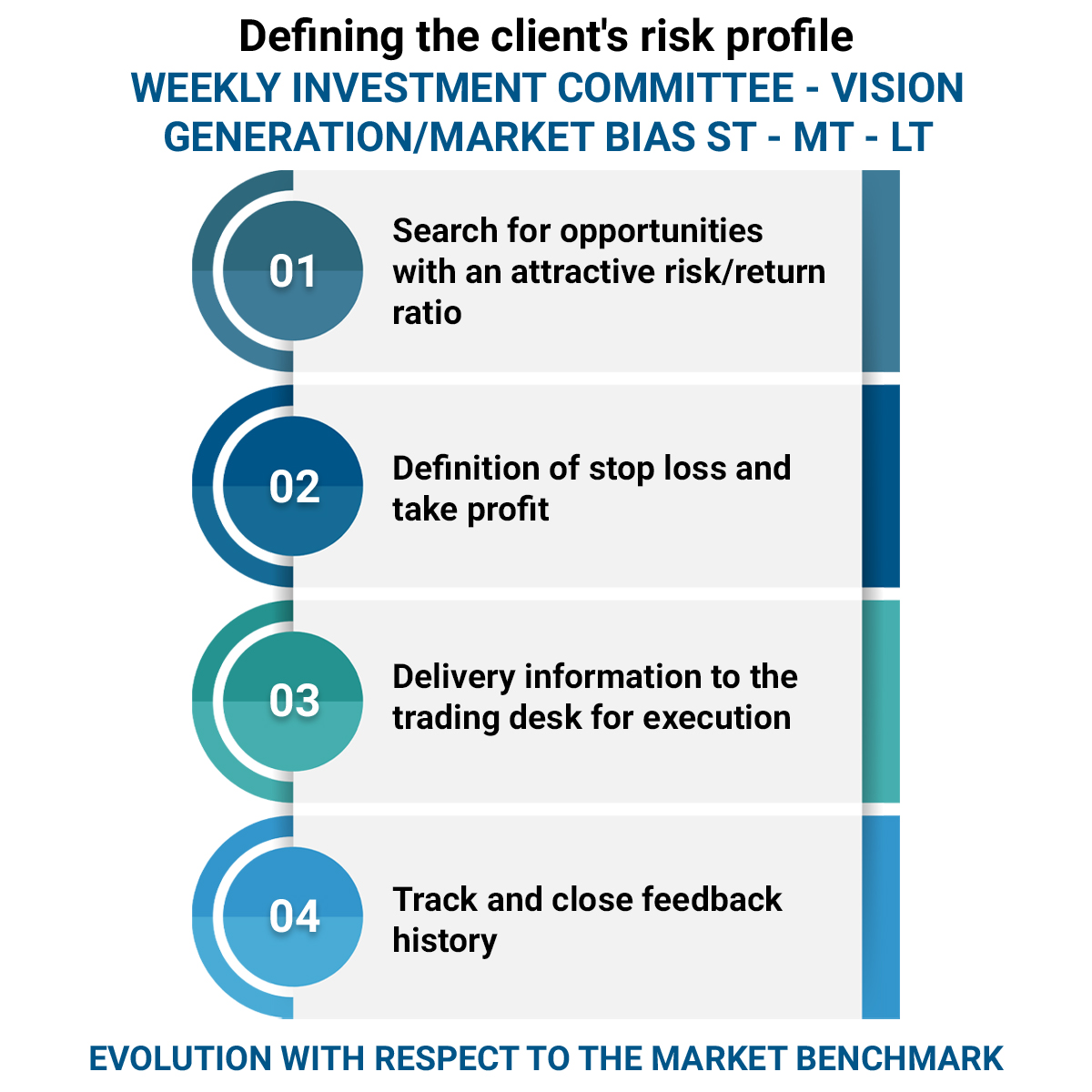

New Asset Allocation format based on the DIS system

- Dynamic Investment Service (DIS), based on a Long-Term Structural Portfolio (LTSP) and a Short-Term Dynamic Portfolio (STDP), both according to the Risk Profile of each client.

- The LTSP will concentrate between 80% and 95% of the equity, depending on the risk profile of each client, with an investment horizon of no less than 2 years with periodic monitoring and monthly reviews.

- The STDP will comprise between 5% and 20% of the total Portfolio, depending on the risk profile of each client, using the investment vehicles already described.

- Both strategies are implemented in accounts under the absolute domain of the client, through the renowned International Broker, Interactive Brokers.

- We classify ourselves as partners of our clients, since our remuneration is based on the profits generated, typically a 2% annual base, plus 20% of the profits, as a succes fee, against the historical maximum of the portfolio.

Proposal

- Customer account opening directly at Interactive Brokers.

- Operation through our trading desk or directly through the transactional platform.

- Reporting online through our website and on the cell phone through the app.

- Variable commission on a case-by-case basis, depending on the strategy and movement.